They re complicated but still legal.

Back door roth ira conversion 2018.

Which should help figure out which type of account you should be using.

The back door roth is a work around that lets people move.

You can do a roth conversion up until dec.

A conversion to a roth ira results in taxation of any untaxed amounts in the traditional ira.

A method that taxpayers can use to place retirement savings in a roth ira even if their income is higher than the maximum the irs allows for regular roth ira contributions.

For 2018 individuals cannot make a roth ira contribution if their income exceeds 199 000 married filing jointly or 135 000 single.

It used to be that you could do over your roth ira conversions.

Why perform a backdoor roth ira conversion.

For example if your traditional ira balance is 20 000 after rolling over money from a 401 k and 2 000 is from nondeductible contributions only 10 of any conversion to a roth will be tax free.

That post details the tax benefits for choosing a roth ira or an ira.

More the complete guide to the roth ira.

Backdoor roth ira conversions.

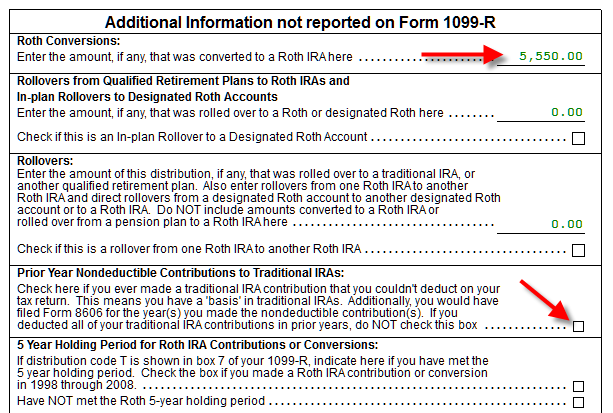

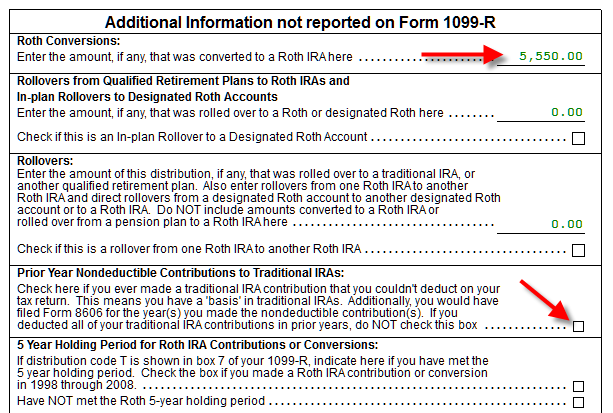

The conversion is reported on form 8606 pdf nondeductible iras.

For a deeper understanding of this topic you can check out that guide.

For 2018 the ability to contribute to a roth ira begins to.

Or because i had a private ira for the calendar year of 2017 i am not eligible for a back door roth.

We get a lot of questions about this.

The backdoor roth ira.

The backdoor roth ira contribution is a strategy and not a product or a type of ira contribution.

A do over meant that you could do conversion and then undo the transaction up until oct.

See publication 590 a contributions to individual retirement arrangements iras for more information.

A backdoor roth ira allows taxpayers to contribute to a roth ira even if their income is higher than the irs approved amount for such contributions.

15th in the following year if you decided that you wanted to avoid the tax hit.

Return to iras faqs.

For instance if i roll my private ira into a company 401k today 1 11 2018 will i be able to star the back door roth strategy once that roll over is done guessing around 1 18 2018.