Therefore you shouldn t ask your ira custodian or trustee for a backdoor roth ira contribution.

Back door roth ira conversion 2017.

You should contribute directly to a roth ira and avoid the backdoor conversion if your magi is below a certain amount.

Can you please elaborate on this edge case.

A conversion to a roth ira results in taxation of any untaxed amounts in the traditional ira.

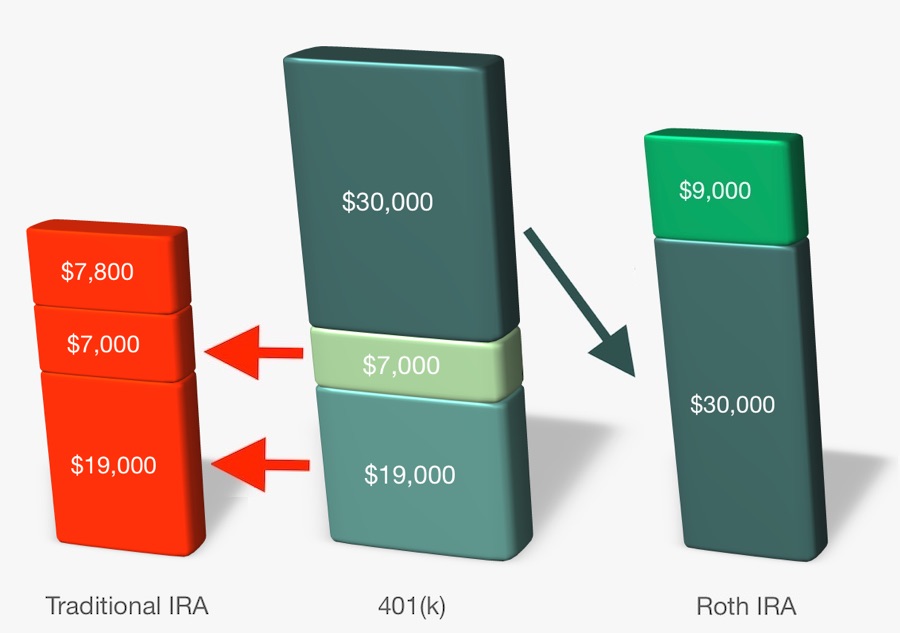

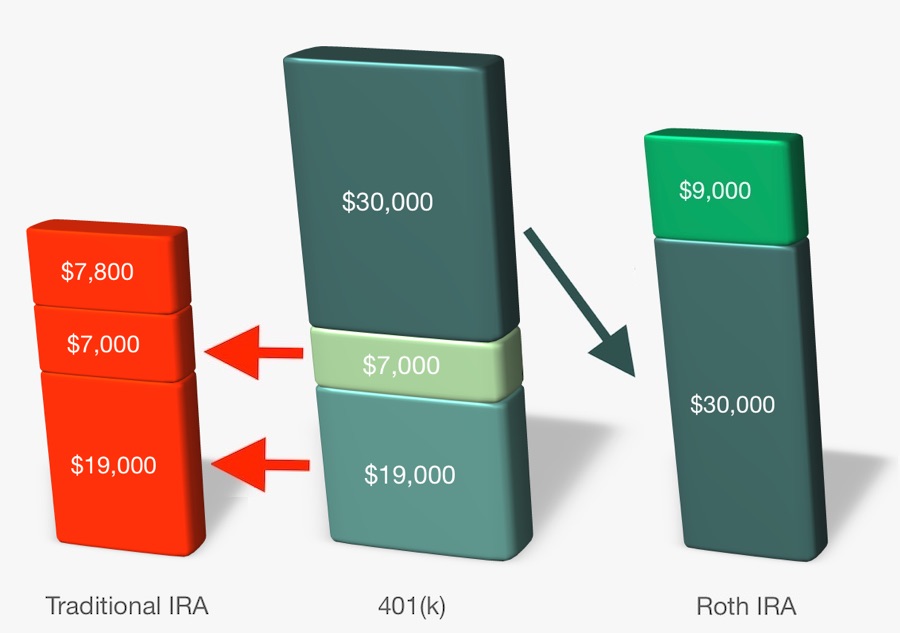

First place your contribution in a traditional ira which has no income limits.

The 2020 tax year income limits are 124 000 for singles and 196 000 for.

The conversion would be part of a 2 step process often referred to as a backdoor strategy.

More the complete guide to the roth ira.

Is there any special steps to follow to have this reported correctly i am planning to do the same contribution for 2017 before filing my return p p thanks p.

A backdoor roth ira allows taxpayers to contribute to a roth ira even if their income is higher than the irs approved amount for such contributions.

Why would i have to pay tax if this is a post tax contribution.

But make sure you understand the tax consequences before using this strategy.

This is post tax ira for backdoor roth conversion.

See publication 590 a contributions to individual retirement arrangements iras for more information.

The conversion is reported on form 8606 pdf nondeductible iras.

Then move the money into a roth ira using a roth conversion.

For instance if i roll my private ira into a company 401k today 1 11 2018 will i be able to star the back door roth strategy once that roll over is done guessing around 1 18 2018.

A method that taxpayers can use to place retirement savings in a roth ira even if their income is higher than the maximum the irs allows for regular roth ira contributions.

When i imported 1099 r from my broker my owed tax amount went significantly high for 5500 contribution.

Or because i had a private ira for the calendar year of 2017 i am not eligible for a back door roth.

If taxpayer a withdraws 5 000 from the ira and rolls it into a roth 500 would be nontaxable 5 000 50 000 x 5 000 withdrawn as part of a conversion but 4 500 would be taxable 5 000 500.